3 min read

Subject to finance: What it means and why it matters

Lindel Enticott

Updated on November 10, 2025

Lindel Enticott

Updated on November 10, 2025

For most buyers in Victoria, securing finance isn’t just a step in the process, it’s the entire foundation of the purchase. That’s where the subject to finance clause comes in. It’s one of the most important protections in your Contract of Sale but is commonly misunderstood.

At Prepared, we help you navigate finance conditions with speed, clarity, and legal precision. Whether you’re buying, selling, or advising, here’s what you need to know.

What is a ‘subject to finance’ clause?

It’s a contractual condition that makes your offer conditional on being approved for a home loan.

If finance is declined (or not approved) you may withdraw, but only if:

.jpg?width=800&height=534&name=Adobe%20Express%20-%20file%20(6).jpg)

- The clause is included in the contract before signing

- You apply for finance immediately and due everything reasonable to obtain finance

- You give written notice before the approval date expires supported by suitable evidence

This clause is not automatic. It must be expressly included in the contract.

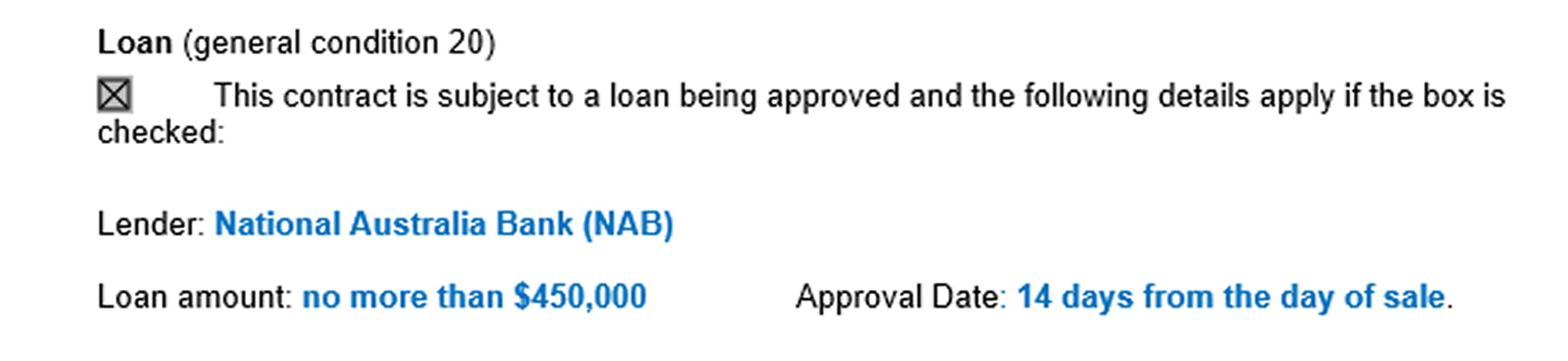

The general condition is usually an Opt-In Box in standard contracts, which then applies if ticked.

Special conditions can also be inserted to provide for a subject to finance clause on other terms (or amend the standard terms).

Why this protection matters for purchasers

The standard Victorian finance clause gives you an exit strategy if your lender says no or doesn't approve you in time, but the general condition that is relied upon in Victoria is only effective if you:

- Apply for the loan straight after signing

- Don't apply for a loan above to the maximum loan amount in the clause

- Notify the seller on or before the finance due date

- Do everything reasonably required to obtain the loan

- Are not in default of any other condition

If you delay applying or fail to give notice, you could lose your right to withdraw and your deposit.

It is important that you seek legal advice on the exact wording used in your contract to ensure you are protected.

Most contracts provide a 14–21 day window for finance approval. You can negotiate a longer or shorter period before signing

Don’t assume the deposit and finance due dates match.

Deposit deadlines are usually fixed whereas finance conditions often allow a short grace period which doesn’t extend to the deposit.

Vendors: know where your sale stands

Until finance is approved or waived, the contract is conditional.

During this time:

- Don’t rely on sale proceeds for your next purchase just yet

- Your agent may avoid adding the sold sticker and continue to market the property under contract

- The buyer’s conveyancer will need to confirm approval status by the due date

If the buyer validly withdraws under the clause, their deposit is refunded in full. Sellers can request evidence that the buyer genuinely attempted to obtain finance.

If they fail to act within the terms, they may lose their deposit or face breach of contract.

- This clause is powerful but not a free pass.

Common Questions from Buyers & Sellers

Q: Can I withdraw under finance if I just change my mind?

A: No. It required good faith actions. You must show that finance was declined or not approved on the appropriate terms and you took reasonable steps to secure it.

Q: What happens if I forget to notify that finance was declined?

A: You may be deemed to have waived the condition and must proceed or risk losing your deposit.

Q: Can the seller request proof that I was rejected?

A: Yes. Sellers are entitled to ask for evidence that you genuinely applied for finance and were declined or not-approved within the conditions of the contract.

Q: What if I need more time for approval?

A: Request an extension before the deadline. The seller can accept or refuse. If refused, and you still can’t obtain finance, you may be able to withdraw (provided you applied promptly and complied with all terms). Make sure you are not in default when negotiating.

The subject to finance clause is a critical shield available to savvy buyers, but it must be used correctly to be effective.

For buyers, this means applying quickly and notifying on time.

For sellers, it’s about knowing when the contract becomes unconditional and what to do if a buyer seeks to exit.

Need help reviewing or negotiating a finance clause? Let’s make sure you’re fully protected before signing.

The information is general in nature and does not constitute legal advice. If you are buying or selling, please contact us to request legal advice.

Understanding the statement of adjustments: What Victorian purchasers and vendors need to know before settlement

When buying or selling a property in Victoria, one conveyancing process that plays a crucial role in ensuring fairness and accuracy at settlement...

.jpg)